The journey to adopt a child can be an emotional and financial roller coaster. Adoption can be uncertain, frustrating, and exciting all at the same time.

Although there is infinitely more to the adoption process than home studies, paperwork, fundraisers, and adoption grants, these activities can take up a significant amount of time.

“When your adoption is finalized and all the paperwork is complete, you just want to relax, connect with your child, and savor the precious moments with your family.”

However, this is also a critical time to stay on top of some important details. There are still things that you should take care of in the days and weeks after your adoption is final in order to protect your family, legally and financially.

Here is a helpful list of 21 things to do after you adopt a child that will give you peace of mind and financial security.

1. Keep Your Child Close To You

Like any relationship, connecting with your adopted child will require time and consistency. For infants and toddlers, keep them especially close to you so they feel safe and comfortable. Snuggling, co-sleeping, and putting them in a sling are a few options to consider. For older kids, sports, games, and other fun activities are a great way to bond and build trust.

2. Get Your Spouse Involved Early

If you’re a two parent family, both parents should play an active role connecting with your child. It’s also important for parents to support each other and set expectations. Now is the time for your spouse to help out around the house with meals, cleaning, bath time, and diaper duty. With support and appreciation, your partner will more than likely embrace his role. If you’re single, you’re likely on double duty and may not have a helping hand. It’s important to plan scheduled breaks, activities, and visits with friends to keep your sanity.

3. Make A List Of Questions

Parenting is hard. Adoption typically brings additional challenges, relationships, and complexities. Some of these things need to be addressed immediately (i.e. attachment disorder) while others may not need to be tackled for several years (i.e. questions from your child about his or her birth parents). Write down your questions and concerns as they come up so you can get answers from professionals or think through your responses and be prepared when your child asks.

4. Create Or Update Your Will

This is a top priority after you adopt a child and one of the best personal finance decisions you can make. A will provides legal and financial protection for your family in the event of an unexpected death of one or both parents. If you haven’t created a will, you can do it quickly and inexpensively. When planning your estate, be sure to update all of your beneficiary information.

Rocket Lawyer is an incredible online resource that provides a ton of legal services at deep discounts. Whether you simply want to use their legal documents or speak directly with an attorney, Rocket Lawyer is great way to create or update your will and protect your family. Pricing starts at $7 per month depending on your needs. If you all you need is a will, this may be the right option for you. Try it FREE!

Rocket Lawyer is an incredible online resource that provides a ton of legal services at deep discounts. Whether you simply want to use their legal documents or speak directly with an attorney, Rocket Lawyer is great way to create or update your will and protect your family. Pricing starts at $7 per month depending on your needs. If you all you need is a will, this may be the right option for you. Try it FREE!

Willing.com is quick, easy, and legally valid in all 50 states. The best part is that it’s 100% FREE. Willing allows you to create separate wills for you and your spouse in 10 minutes or less. When you’re finished, simply print your will and sign along with two other witnesses and your will becomes valid. Willing seems best suited for families with relatively simple financial situations. If you own several properties and/or a business, you may want to consider another option. If you don’t currently have a will, at the very least, use Willing to create one immediately and protect your family in case of an emergency.

Find an attorney in your area to handle your estate planning needs. Here’s a helpful article on how to find an excellent estate planning attorney.

5. Adjust Your Insurance and Employer Benefits

Like a will, insurance is about protecting your family and providing peace of mind. During your adoption process, call each of your insurance providers to find out what is required for your child to be added to your policy, when they can be added, and if there will be any changes to the policy including coverage and cost. Having answers to these questions will help you plan accordingly.

If you are required to wait until your adoption is finalized and provide additional documentation, then be sure to get everything you need and add your child to all of your insurance policies immediately. Most likely, the insurance policies that you will need to update include medical, dental, disability, and life insurance.

Check with the human resources department at your work and add your child as quickly as possible because you don’t want to get stuck with a sick child and no coverage. Most employer benefits plans allow 30 days from the date of birth or adoption placement to add a child to your coverage.

If your child receives medical care as part of an adoption assistance program, then be sure to update the name and contact information.

When it comes to insurance, everyone has a different level of comfort. Be sure to discuss coverage with your spouse or significant other so that you are both on the same page.

If you don’t already have medical or life insurance or if you’re not satisfied with your current provider, then consider PolicyGenius. It’s a simple and fast way to get the right insurance policy at the right price. PolicyGenius gives unbiased advice, lets you compare insurance coverage and prices, and allows you to buy directly from them.

Medi-Share is a Christian health insurance alternative. It offers most of the same benefits as traditional health insurance, but with lower premiums. Most families can save anywhere between 30-50% in premiums each year. Medi-Share is an excellent option for individuals and families seeking affordable medical insurance that aligns with their values and religious beliefs while meeting the requirements of The Affordable Healthcare Act.

6. Update Social Security For Disability Benefits

If your child was receiving disability benefits, contact your Social Security office. You will need to provide his or her new name, the date of the adoption decree, and your name and address as adopting parents. The adoption should not cause the child’s benefits to stop.

7. Tell Your Family And Friends

Call, text, tweet, post…you don’t need us to tell you. However, for some people, making an adoption announcement via social media is all they need to do. For others, they wouldn’t dare miss the opportunity to send out an announcement with a cute photo to family and friends. Shutterfly has great options for quickly and easily sending your announcements, especially if time is limited. If you’re the creative type and can find the time, design your own. Either way, aim for sending out an adoption announcement within 1-2 weeks while it’s still fresh and before life gets out of control.

8. Write Down Your Child’s Adoption Story

Personally, it doesn’t matter if your child was adopted or birthed by you, both are incredible events that you want remember and celebrate. In order to preserve the full story and not forget anything, write down your child’s adoption story and include important details that happened during the process. Do it now and periodically go back and read it. Your child’s adoption story is definitely not something you ever want to forget. More importantly, it may help shape part of his or her identity by answering important family questions or filling in gaps about the past. Let your words be transparent, compassionate, and uplifting.

9. Schedule A Family Photo Shoot

Red Thread Sessions celebrates adoption through photography by capturing family portraits of new families along with the precious, happy, confusing, exciting, exhausting, traumatic, life-changing time that is so often brief and fleeting in the life of an adoptive family. Find a professional photographer located in your area that offers discounted and free sessions.

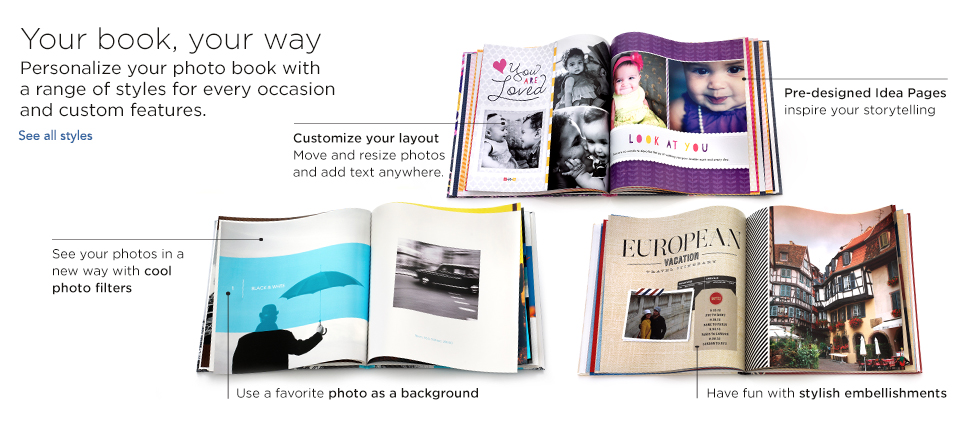

Source: Shutterfly

10. Create An Adoption Photo Book

Long after you adopt a child, hold on to your most treasured memories by turning your favorite adoption pictures, stories, and quotes into an adoption photo book. One of the best ways to capture your adoption journey and revisit important details later on.

11. Choose An Adoption Aware Pediatrician In Your Insurance Network

It’s best to find a pediatrician before you adopt a child. However, if you haven’t, then now is a good time to look for one within your insurance network that is experienced with adoption. Talk to your adoptive parent support group, adoption agency, and ask for recommendations from other families to learn about experienced adoption aware pediatricians in your area.

12. Schedule Your Child’s First Doctor’s Appointment

Whether you adopted domestically or internationally, as soon as you have your pediatrician picked out, schedule your child’s first doctor’s appointment.

13. Submit All The Paperwork

Legal documents such as an original birth certificate and social security card are essential. Depending on the type of adoption, you will likely need to mail in specific documents. Your adoption attorney or agency should provide the required list of documents and help you through this process.

If you adopted internationally, we highly recommend working with an experienced adoption attorney and member of the American Academy of Adoption Attorneys to represent you through the immigration and citizenship process. Your adopted child does not acquire citizenship automatically. In order to become a citizen, you must apply to the Bureau of Citizenship and Immigration Services in the Department of Homeland Security (USCIS). If you use an attorney, then you can expect to pay at least $1,500 for these services.

14. Set Up A Support System

Ask family and friends to surround you and help out. Don’t be afraid to ask for help. We recommend doing this long before your adoption is final. However, some people simply don’t get around to it or don’t realize how important it will be to have support from other people. In some instances, depending on the child’s history, level of trauma, and other factors, parenting an adopted child can be completely different than parenting a biological child. Most people who haven’t adopted or been closely connected with other adoptive families, don’t understand how parenting an adopted child can be so different. That’s ok. It often requires training and/or hands on experience to understand.

Reach out to other adoptive parents and support groups. No one understands your struggles as well as those who have experienced the same things as you. We recommend finding 2-3 other adoptive parents who will commit to being part of your 2 am team. You simply create a pact that you will be there for each other NO MATTER WHAT when you need someone to talk to or a place to drop your kids off at because you need a break…even if it’s 2 am!

15. Adjust Your Budget

According to the U.S. Department of Agriculture, a middle-income, married couple with two children is estimated to spend nearly a quarter of a million dollars to raise a child from birth through age 17. This doesn’t even take into account expenses for college.

Whether your child was born to you biologically, or if you adopted an infant or an older child, on average, you can expect to spend over $12,000 per year to raise a child.

In other words, you need to review your financial priorities and maybe even reset them if necessary. Go over each spending category in your budget.

Depending on the age of your child, it will affect the type of expenses you account for. Housing, food, and child care tend to be the three biggest expenses. And even though you may go through an endless supply of baby food, formula, and diapers early on, children tend to be less expensive when they are younger. You can expect food, clothing, transportation, and health care costs to rise with age.

16. Increase Your Savings

17. Plan For Child Care

Whether you decide to return to work or be a stay-at-home parent, it is a major decision that will impact your family. Talk with other adoptive parents to find out what challenges they experienced and what worked for them.

Consider the financial cost as well as the options of care best suited to your child. Whether it be a relative, nanny, daycare center, or in-home daycare, will the person or people caring for your child have experience working with adopted children and others from hard places? Will they offer the one-on-one attention your child requires? Do they have specialized training to address special needs and behaviors? These are critical aspects to consider.

18. Meet With Your CPA About The Adoption Tax Credit

Most families have a difficult time understanding how the Adoption Tax Credit works. Talk to your accountant about your adoption expenses and tax liability to find out if you will benefit from the adoption credit. If you haven’t worked with a CPA before, then contact Bills Tax Service for a free consultation. The company is licensed in all 50 states and has an Adoption Tax Credit Specialist® on staff.

19. Save For College

Did you know you can get a head start and begin saving for your child’s college before birth or your adoption is finalized. Simply open an account in your own name and transfer the gifts there. After your child is born or adopted and has a social security number, then change the beneficiary of the plan to your child.

The two most common types of college savings accounts are Coverdell Education Savings Accounts (ESA) and 529 plans. ESAs provide tax-free earnings growth and tax-free withdrawals when the funds are spent on qualified expenses from K-12 and on through college. An ESA allows you to invest up to $2,000 per year and typically offer more investment options and lower fees than 529 plans.

If you want to save more than $2,000 per year, or if your income disqualifies you from participating in an ESA, there are no annual limits on contributions made to a 529 plan.

![]()

Upromise is a smart way to start saving for your kids’ college. Upromise offers 529 College Savings Plans, life insurance plans, high yield saving accounts, and even offers cash back earnings on everyday purchases.

![]()

TD Ameritrade offers Coverdell Education Savings Accounts (ESAs) and 529 College Savings Plans designed to meet the needs of virtually every family and every budget. No minimum annual contribution is required.

20. Choose A Meal Plan

This could change your life…especially after adopting and having kids. Seriously. Imagine, you run around all day long and find yourself stressed out and staring in the fridge at 5pm wondering what you can scrape together to feed your family. Not anymore.

While there are some great meal plans out there, we LOVE MyFreezEasy because you get up to 12 delicious meals prepared from scratch and stocked in your freezer in less than one hour. We use this meal plan and highly recommend it!

Click Here –> To Get Your Exclusive 20% Discount From MyFreezeEasy!

21. Continue Funding Your Retirement

While you are focusing on your new family member, don’t forget to plan for your future. Continue saving for retirement in the same way you did before the adoption. Consider or continue to invest in your 401(k). If your employer offers a match, be sure to contribute at least up to the amount of the match. This is free money. For example, if your company matches your contributions up to 3%, designate at least 3% of your salary to your 401(k).

If your employer doesn’t offer a 401(k) plan or if you want to set aside additional money, consider a Roth IRA or traditional IRA (individual retirement account). You can set up an IRA quickly online through an online brokerage account.

22. Give Yourself A Break

Don’t forget to take care of yourself. Get sleep. Take breaks. Find a babysitter, get dressed up, put your makeup on, paint your nails, comb your hair (guys) and don’t give up date night with your spouse. If you’re single, make time to visit your friends. I know you’re tired and don’t feel like going out…but you need it and your relationships do too. Trying to do everything on your own, skipping breaks, and other limited opportunities to stay healthy and connected isn’t good for you, your child, or your family and will eventually catch up with you.

Jeremy Resmer

Latest posts by Jeremy Resmer (see all)

- 21 Things To Do After You Adopt A Child - March 3, 2017

- 10 Adoption Grants For Everyone - November 15, 2016

- Considering Interest Free Adoption Loans? - November 7, 2016